I must admit, before November 2022 I had not heard (or maybe more likely not registered) of the...

Industrial Manufacturers should leverage marketplace models to engage with customers

Summary:

I was recently asked this question by Peter Evans and the way he posed it was written in a very provocative way,

Should large industrial manufacturers use a digital marketplace investment to bypass their distributors and go DTC creating a direct connection and access to first party data? Or should they build a hybrid or modified marketplace that only onboards their distributors and leaves DTC to them and remain without first party data?

TLDR:

It Depends - for some scenarios this makes complete sense. Industrial Manufacturers could build marketplaces to engage directly with end users when there's a simple well understood application in a commodity market. AS LONG AS they take into account the cost of having a hybrid model (likely not 100% of their business can be supported in this new marketplace model), the cost to implement the requisite capabilities that their former channel partner was delivering on their behalf is also part of the calculation.

There are many more scenarios where either the complexity of the solution or the end-users ability to tolerate inherent risk in the decision-making process (Beta Risk (β)) where a hybrid approach makes the most sense. The hybrid approach maintains a balance between the manufacturer, distribution, and end customer.

Definitions:

Some definitions and framing to put the question into a common context first:

- I'm building into this question an assumption that Large Industrial Manufacturers got to market model is primarily B2B2C

- What is the function of a marketplace? To optionally match demand to supply, drive efficiency (reduce friction, increase velocity, reduce variability, maximize optionality (selection, price, availability))

- For this question, an important consideration is where, how, and how often does value exchange? Is there a "set-up cost" or "transaction cost" potential energy gap to overcome?

- Which transactions will be facilitated by the marketplace (Informational, Product/Service, Value)

- Where are you in the customer journey (Discovery, Consideration, Trial, Negotiate, Purchase, Repurchase, Service)

- Roles and responsibilities (R&R) within the marketplace - for a simple transaction to occur R&R are relatively straight-forward to assign to parties. For complicated sales or sales with significant risk, R&R are more difficult to suss out.

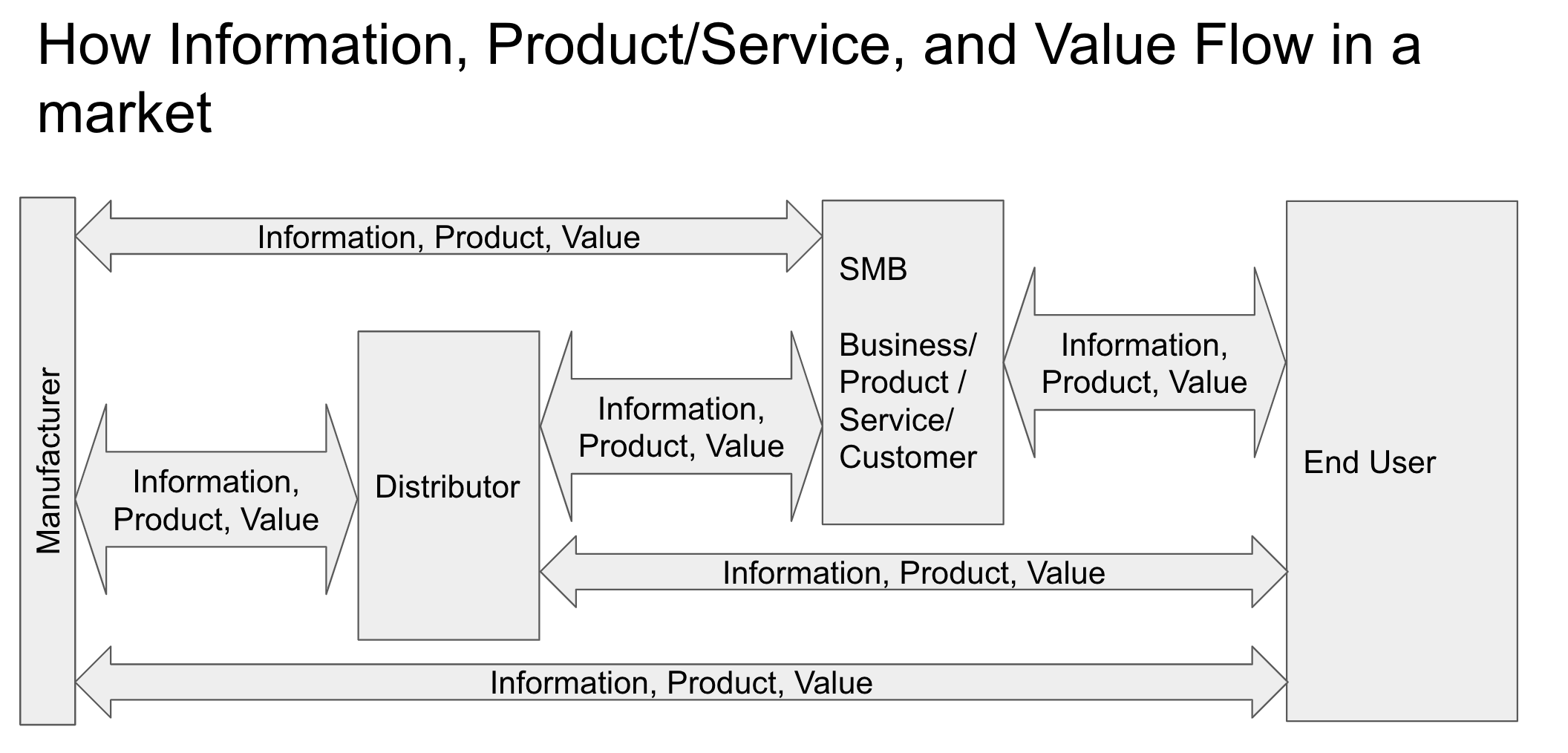

Here is my mental model

If the End User can make a well-informed purchase decision only relying on the information provided by the SMB, then the transaction can proceed. If however the solution or application is complex - they may need to engage with the Distributor (who likely has a specialty, or area of expertise that makes them relevant for that end user and can provide advice on product selection). This engagement reduces the Beta risk (β)of making a career-limiting move (CLM) by choosing the wrong product or solution. In really high-risk decisions OR where there is a lot of complexity or uncertainty - the End User will want to engage directly with the manufacturer to de-risk the transaction.

Now thinking about how a marketplace might fit into this model I could imagine there being a subset of transactions where a manufacturer creates a marketplace to engage directly with the end user to influence their decision-making ... in return, they gain insight into their market (something that is generally very opaque since distribution owns most of the touchpoints with the actual users of the products).

I believe the main value of the direct relationship with the customer (access to the 1P data) is the crux of Peter's motivation for a Manufacturer to build and own (control) a Markeplace vs relinquish that part of the sales process to distribution partners. There are many ways to trade data (information) in a collaborative way so that both parties benefit.

Parallel Flows in the Mental Model

Important to this model is to break the ultimate transaction into three parts - Informational, Product/Service, Value, and pieces of these transactions might flow through different parties.

Informational Flow needs to address how information flows between parties in the model are important considerations when looking at a Marketplace.

-

-

- Commodity vs complex sale - information on solutions are offered - if it is a low risk substitution (switching cost and risk low).

- Level of risk (beta risk - being wrong) is reduced when information close to your use case is available.

- Who (or what) is “doing the selling”, how does the buying happen - is it consultative selling or self-serve?

- Multiple options for the buyer (marketplace) (competing solutions from multiple manufacturers - how do you choose which option is best)

- Manufacturer goal is to identify and market-to ideal customers and then get into their consideration set and ultimately win the purchase.

- Sometimes the channel partners goal is not aligned with the manufacturer (M1) - their goal may be to maximize category profit - so recommending solution 1 vs solution 2 helps their scorecard and not M1

- Testing, assessment, trials, pilots, those all happen before the first sale and likely before the “second sale”. The second sale is confirmation the product actually met the buyers expectations and "is working"

- First purchase is difficult - there is a buyers chasm to cross. Subsequent purchases the dynamic changes and the consideration is less about the product and more about the cost of the supply process (friction and optimization of the re-purchase process)

- The manufacturer cares about maintaining the business - who’s in the best position to accomplish that? Who maintains the business once it's won? In a marketplace this is not clear.

- Switching source of supply, beating up distribution, dual sourcing, all cost from a relationship perspective and ultimately add friction to all the transactions

- Commodity vs complex sale - information on solutions are offered - if it is a low risk substitution (switching cost and risk low).

-

Product Flow - Logistics and supply chain considerations are really important to cover

-

-

- Manufacturers are not necessarily “optimized” to logistically deliver small quantities of product to an end user. Not impossible but hard.

- If you consider the traditional B2B selling approach larger quantities (durably packed i.e. cardboard cases appropriately packaged) you might consider leveraging a 3P fulfillment partner

- What are the roles of a channel … traditional, still true today? How does the channel survive (I think it does) but to survive it must evolve - how and where it delivers value.

- Value proposition for SMB business - integrated supply, JIT inventory, keep stock, vending machines, VMI, integrated invoicing, cost-out-contracting, consolidated shipping, one throat to choke - does a manufacturer really want to take all of this on?

- The converse argument is new entrants (3P, BNPL, Scale Integrators) into the value chain have upended traditional distribution models and is causing traditional distribution to evolve or exit certain segments.

- Returns (reverse logistics) is an equally complicated process and must be included as a critical step (including quality assessment, refunds, material tracking and product destruction)

- Then there is the data as part of the bill of materials that is required to convey along with the actual product (Certificates of Conformance (COC), Certifications of Authenticity (certs), Quality control test data (per lot or batch))

- Note on Certificate of authenticity - fraud, compliance, grey market (blockchain solution?)

- Impedance matching partners and GTM models is the key. Not all distributor partners are created equal. Alignment is beautiful. Mismatched speeds is exactly where friction kicks in and slows everything to the slowest common denominator.

-

Value Flow - how $ is distributed across all the parties is important - according to the value delivered

-

-

- Who’s getting paid for what value they add in the value chain. Super important to understand as new entrants exploit imbalance between parties

- Where do the costs attract in the model and how do profit margins attract competition

- Who’s getting paid for what value they add in the value chain. Super important to understand as new entrants exploit imbalance between parties

-

"Your Profit margin is my business opportunity" -Bezos (link)

-

-

- How does that value dynamic change over time and through the customer buying journey?

-

-

-

- Everyone needs to maintain profit or the flow stops. Flow - steady, consistent, without friction, is a hallmark of a well-balanced system

- Manufacturer = sales, marketing, R&D, LSGA, profit margins, Cost Of Poor Quality (COPQ)

- Distributor = operations, sales, inventory, carrying costs, expertise, deal management, cost to maintain relationships with multiple manufacturers

- SMB Customer = extracts value from the solution, pays money, satisfaction, switching costs (and risks)

- Other players = Transportation, Cost of Credit

- End user of the product (or service) ultimately dictates volume, price the market will bear, longevity of the solution or impetus to find an alternative.

- The pursuit of value has caused parties to vertically integrate to try and capture more of the value in the marketplace. Manufacturers become distributors, distributors become manufacturers (private label, service extensions)

- Everyone needs to maintain profit or the flow stops. Flow - steady, consistent, without friction, is a hallmark of a well-balanced system

-

Risk - in B2B transactions the risk of making a career-limiting move (CLM) is real so companies engineer-in processes to minimize Beta (β)

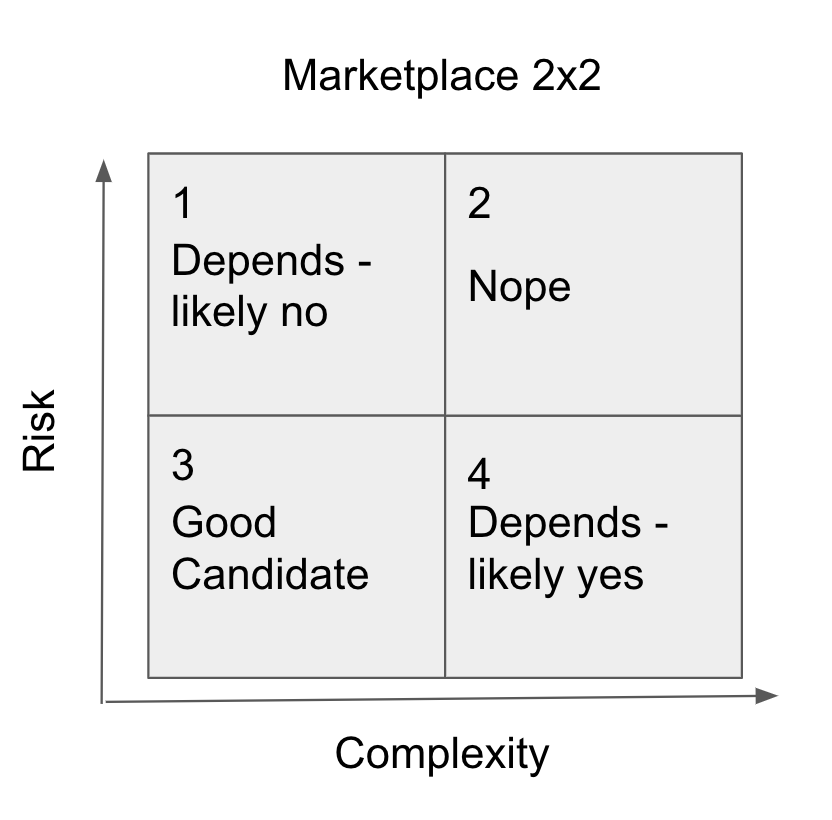

B2B Selling dimensions when considering a Marketplace

|

Define risk in this case as the decision maker making a career limiting move if they pick the wrong product for a given application. Define complexity here as how novel the problem is, or how many other inputs are a consideration in subsequent steps.

Transactions can migrate with experience from quadrant 2 to 1, or from 2 to 4 over time as all parties become more comfortable with the solution. Likewise migration from 1 to 3 can also happen over time. I can’t think of a scenario where 4 to 3 could happen. |

|

Customer Journey - depending on risk profile and solution complexity Marketplaces may make sense for the entire funnel. In other scenarios, marketplaces may have limited (no) application.

Customer Journey

|

|

A few words about The Complexity of B2B Markets

Law of big numbers drives complexity

Directionally Correct US Market #s for illustration

|

Value Chain Step |

US Count |

Products |

Value Prop |

|

Large Industrial Manufacturers |

100’s |

Many Thousands |

We make products and sell through distribution Do I want to invest in capabilities to go direct? What's the ROI |

|

Industrial Distribution |

160,000 |

Many Millions |

We sell products like these into specific markets. Am I adding enough value? Should I manufacture? Access and Portfolio |

|

SMB Business/ Product/Service |

10,000,000 |

Normally a single LOB |

Value proposition - We solve problems like this. Can I take on more supplier relationships? What’s the cost? |

|

End User |

300,000,000 |

One problem to solve (today) |

|

Two of the biggest complexity challenges in this market are:

- The lack of an agreed taxonomy for product data (security through obscurity). There has not been a single unifying forcing function to drive this in the market. Potentially something AI/ML could attack (I have some ideas) but not clear how some of the nuance can be built into the training models.

- Application-dependent appropriateness for substitutions between manufacturers. Sometimes you can substitute product 1 for product 2, but the responsibility to test if the change is appropriate lies on the decision maker ... and this could present a big risk without sufficient testing.

A (hopefully) helpful scenario example

RV Example Supply Chain

Lets suppose we have this supply chain scenario in the RV market.- Fibreglass Composite Manufacturer

- Specialty Distributor (Elkhart, Humint, Market Int, Trust, Access)

- Forest River RV (RV manufacturer)

- Gander Outdoors / RV.com (RV Seller)

- Consumer (RV Purchaser)

In this scenario - does a marketplace make sense for the Consumer wrt RV Manufacturers ... possibly. But that's really the function of the RV Seller already in place.

Does RV Manufacturer benefit from a marketplace offered by a fibreglass composite manufacturer? Not likely.

The value delivered by the Specialty distributor (local presence for stock and service, human intelligence of what's going on the at specific accounts and the problems they're trying to solve, market intelligence relative to RV manufacturing industry, years of trust and partnership, access to all the manufacturers product assortments that are relevant to an RV manufacturer. Hard to replace all this value and complex interactions with "a marketplace"

Big questions require deep dives to sort out what is the best path for you (and Hypothesis testing considerations).

Big Questions companies struggle with

- Manufacutrers - should I become Distributor or invent new category (Apple, Tesla) or execute against a new business model (paying for the outcome (i.e. painted car on an assembly line) vs paying for the paint)

- Distributor - should I become a manufacturer (vertical) or is a better strategy to horizontal roll up (scale for synergy or broaden selection)?

- SMB - How much logistics and sourcing do I want to take on? Do any of these strategies increase or decrease friction in the value chain? And for whom.

- End user - help me de-risk, move fast, DIFM, help me reach my goal

Parting shots (and potential fodder for future blog posts)

The most profitable companies on the planet have become Platforms through consolidation (virtual or actual) up and down the value chain. Some achieved this a-priori, some evolved into this over time.

The feared "Race to the bottom" caused by the internet - never really happened - more value is being produced in these companies than ever. Markets did change (enter Amazon Business) but the total pie grew too, consolidation has happened, profitability has shifted around, and there's more industrial distribution than ever. Important to be really clear about your business model and value proposition to suss out where you win (and build sustainable competitive advantage.

Some recommended reading: